Double-Entry Bookkeeping Excel Template

$9.00

Available in stock

Already have an account? Login

Add to cart| Available Formats | MS Excel |

|---|

Description

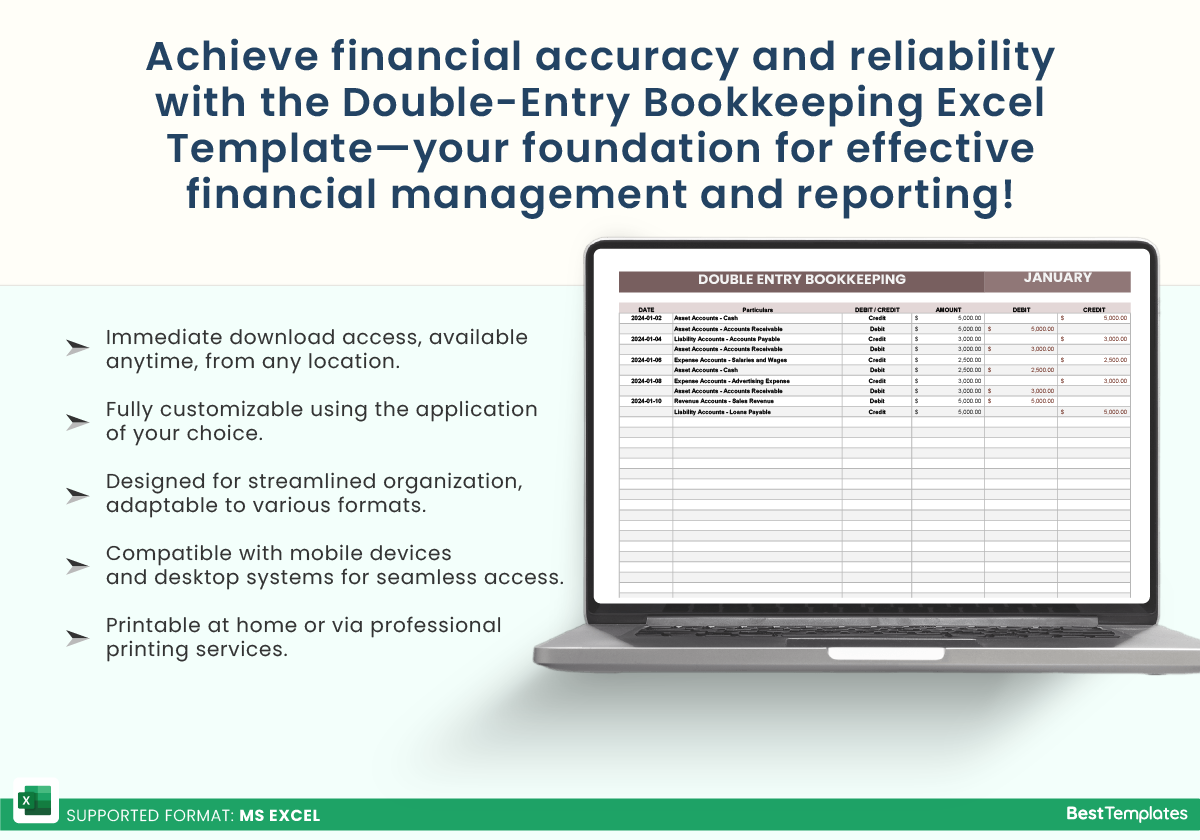

Introducing the Double-Entry Bookkeeping Excel Template from Besttemplates.com, an essential tool for businesses and accountants to maintain accurate and reliable financial records. This template is designed to follow the fundamental principle of double-entry bookkeeping, where every financial transaction affects at least two accounts, keeping your books balanced and ensuring accurate reporting.

With its clear and structured layout, the Double-Entry Bookkeeping sheet allows you to record every transaction with Date, Particulars, Debit/Credit Entries, and Amounts. Each transaction is meticulously tracked, ensuring that both the debit and credit sides match perfectly. This method ensures accuracy in tracking your Assets, Liabilities, Equity, Revenue, and Expenses over the course of each month.

The template is spread across 12 tabs, one for each month, allowing you to easily log your financial entries on a month-by-month basis. This ensures that your bookkeeping remains organized and accessible at all times, making it easy to reconcile accounts and generate financial reports.

Key Features:

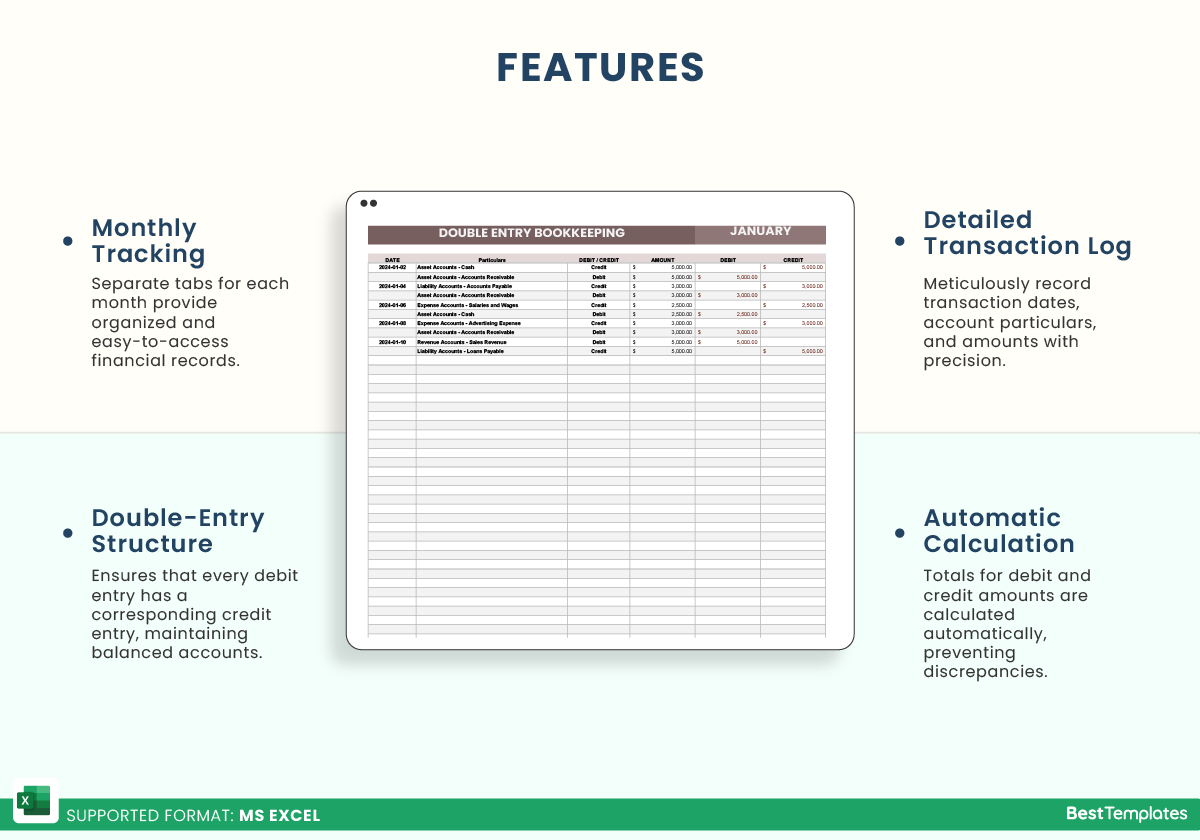

- Monthly Tracking: Separate tabs for each month (January to December) allow for organized and easy-to-access financial records.

- Double-Entry Structure: Ensures that for every debit entry, there is a corresponding credit entry, helping you keep your accounts balanced.

- Detailed Transaction Log: Record transaction dates, account particulars, debit/credit nature, and amounts with precision.

- Automatic Calculation: Totals for debit and credit amounts are automatically calculated to prevent discrepancies.

- Comprehensive Account Management: Track and manage all essential accounts such as Assets, Liabilities, Equity, Revenues, and Expenses.

- Professional Layout: Clean and easy-to-use design, ideal for professional accountants, business owners, or anyone managing company finances.

With the Besttemplates.com Double-Entry Bookkeeping Excel Template, managing your finances becomes simple and efficient. This template helps you maintain financial accuracy, ensures all your accounts are balanced, and provides a reliable foundation for financial reporting and analysis.

Additional Information

| Available Formats | MS Excel |

|---|

Additional Product Info

- Compatibility: Excel 2013, 2016, 2019, 2021, Office 365

- Functionality: No VBA Macros or custom scripts needed

- Orientation Options: Landscape

- Color Mode: RGB Color Space

- License Type: Standard License

- Customization: Easily editable and customizable

- Font Style: Business standard fonts are used

- Digital Optimization: Optimized for digital use only

- Printing Suitability: Suitable for printing

No products in the cart.

No products in the cart.