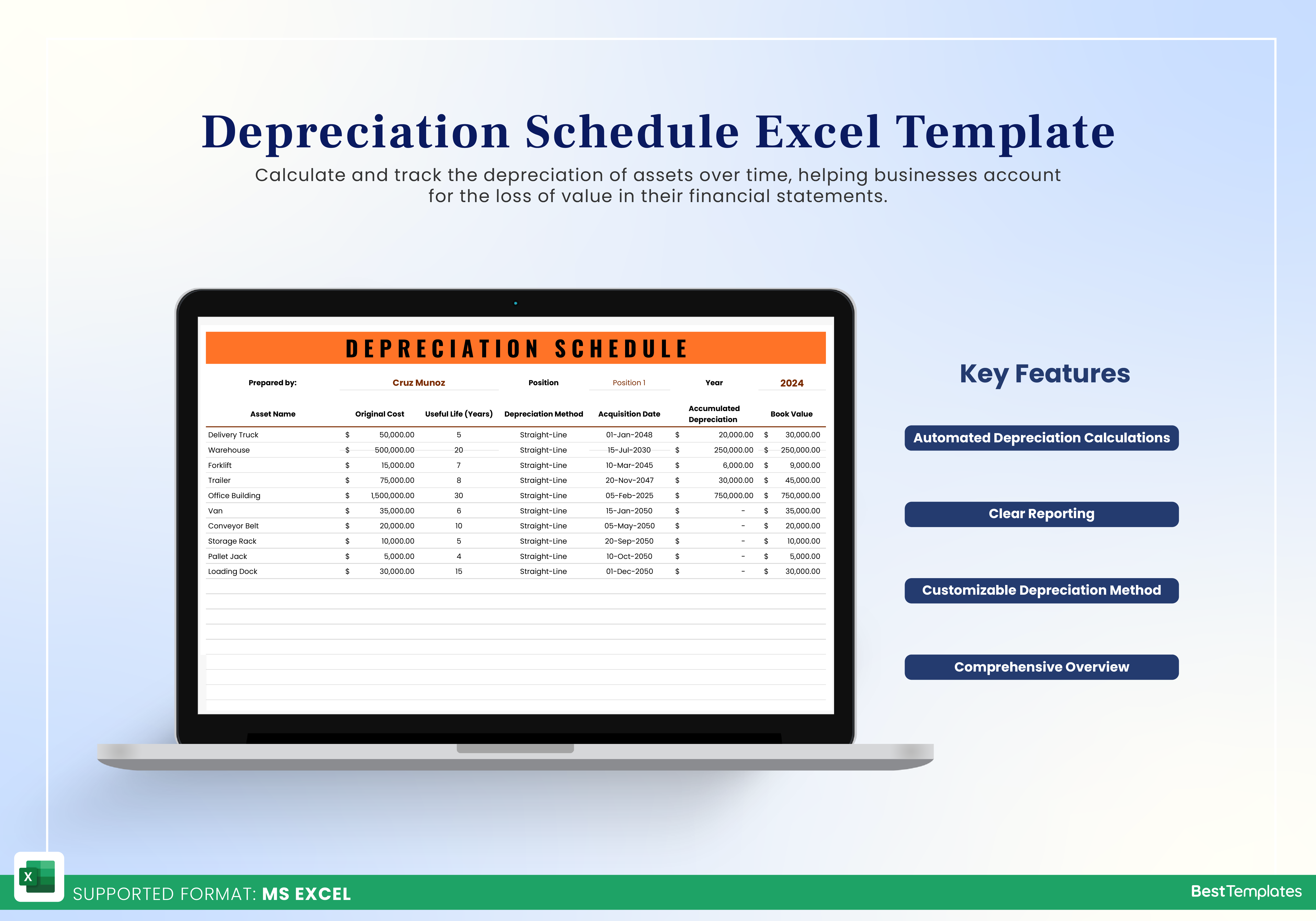

Depreciation Schedule Excel Template

$9.00

Available in stock

Already have an account? Login

Add to cart| Available Formats | MS Excel |

|---|

Description

Simplify your asset management and ensure accurate financial reporting with the Depreciation Schedule Excel Template from Besttemplates.com. This easy-to-use tool is perfect for businesses of any size, allowing you to track the depreciation of various assets over their useful lives. Whether you’re handling a small fleet of vehicles or managing a vast array of equipment, this template helps you stay organized while adhering to accounting standards.

The template is designed for efficiency, providing automated calculations for accumulated depreciation and book value. Just input essential details such as the asset name, original cost, useful life, and acquisition date, and the template takes care of the rest. It supports Straight-Line depreciation, but it can easily be adapted to other methods depending on your needs. You can manage everything from office buildings to forklifts, keeping your financial statements up to date.

Key Features:

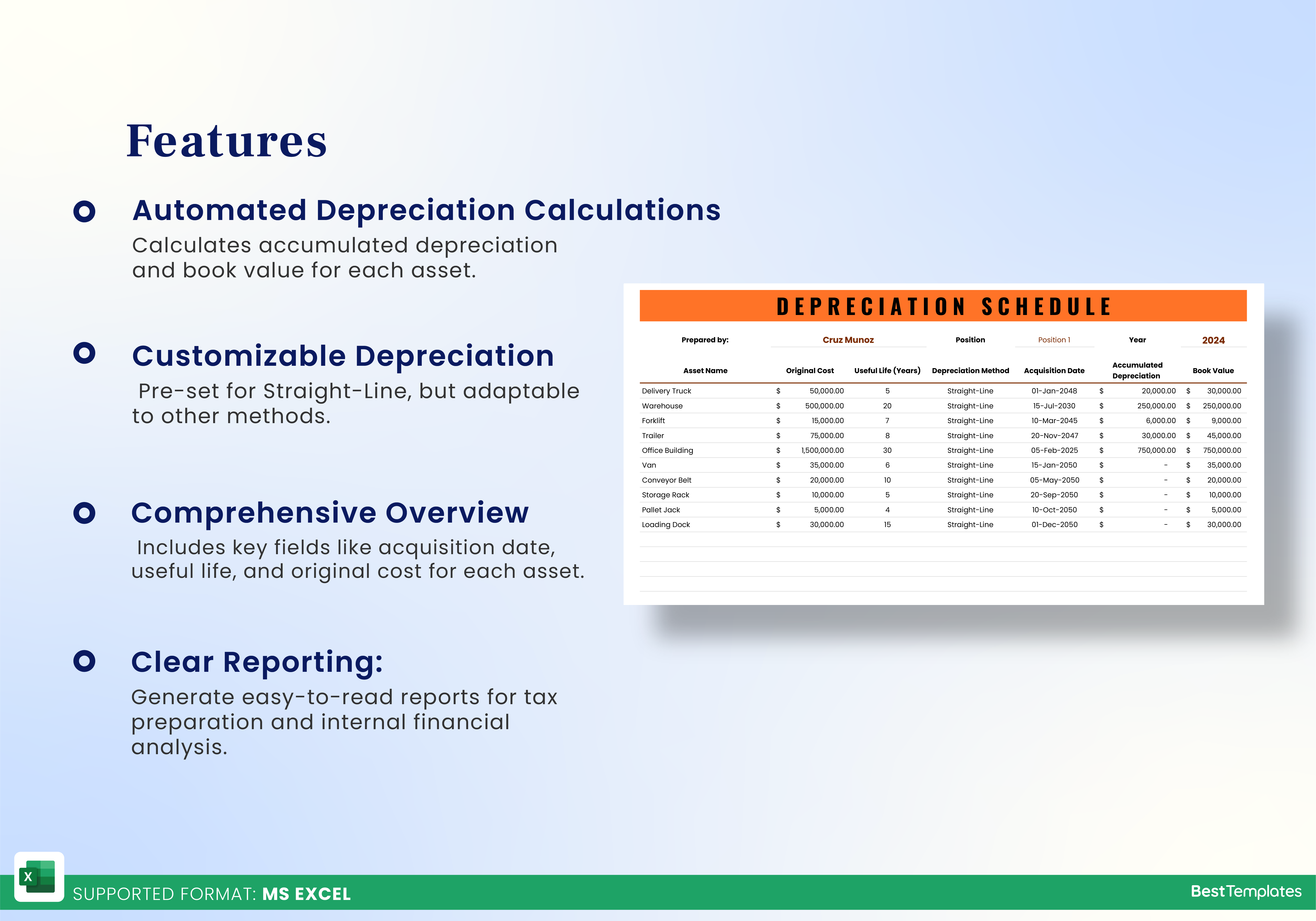

- Automated Depreciation Calculations: Calculates accumulated depreciation and book value for each asset.

- Multiple Asset Types: Track vehicles, equipment, buildings, and more.

- Customizable Depreciation Method: Pre-set for Straight-Line, but adaptable to other methods.

- Comprehensive Overview: Includes key fields like acquisition date, useful life, and original cost for each asset.

- Clear Reporting: Generate easy-to-read reports for tax preparation and internal financial analysis.

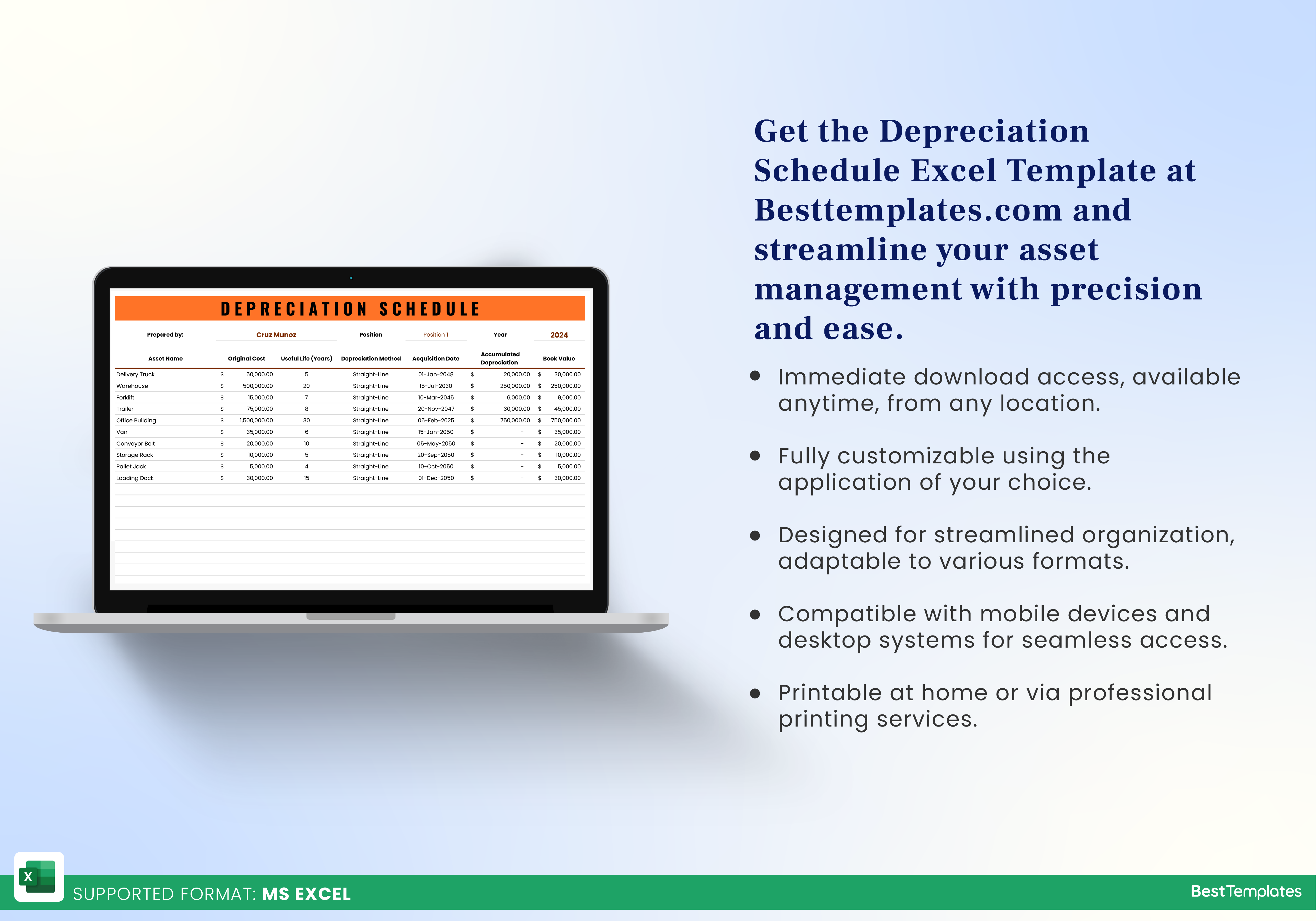

Get the Depreciation Schedule Excel Template at Besttemplates.com and streamline your asset management with precision and ease.

Additional Information

| Available Formats | MS Excel |

|---|

Additional Product Info

- Compatibility: Excel 2013, 2016, 2019, 2021, Office 365

- Functionality: No VBA Macros or custom scripts needed

- Orientation Options: Portrait/Landscape

- Color Mode: RGB Color Space

- License Type: Standard License

- Customization: Easily editable and customizable

- Font Style: Business standard fonts are used

- Digital Optimization: Optimized for digital use only

- Printing Suitability: Suitable for printing

No products in the cart.

No products in the cart.