A lot of people believe that having their own business will pave the way to becoming their own boss. However, too many people fail to plan properly, resulting in a wide variety of businesses failing within six months of operation. In order to avoid such massive loss, it is important to ask the right questions before starting a business. This long business checklist will help you assess yourself honestly, so take a look at these questions and answer them as honestly as you can so that you will know if you are cut out to become a successful entrepreneur.

Essential Questions to Ask Yourself

The Most Important Questions

First, you have to ask yourself the most essential questions regarding your desire to run a business that will help you decide whether or not you should go all in.

-

What Problem Will I be Solving With This Business?

The value of your business is its most important determining point. You need to think on your business’s functionality. For instance, would a new restaurant help draw a crowd to your community? Have you found a way to keep coffee hotter, longer? Whatever your purpose for business is, make sure that you have your eyes on the goal.

-

How Much Money do I Absolutely Need to Start?

You could dream up of opening your own gallery to sell some art, or share your love for food with a new concept restaurant. Whatever you wish to do, keep in mind that a lot of money will be needed to open up a store. However, you don’t have to start from there. Think about how much money you absolutely need to start – not how much you’d ideally like to have in the bank. Start with selling some of your art online, or make some food to sell at farmers’ markets. Even the slightest exposure can be a great start for your business.

-

Who are My Competitors?

It’s essential that you have to know your closest competitors in your target market. You won’t be the only pizzeria in town, so you have to know how to make yours better. If you can’t offer a better, if not different option, then you might want to rethink your business plan.

-

What Gives me an Edge Compared to My Competitors?

Speaking of differentiating your business, you may also want to think what edge you can offer that’s different from others. For instance, do you offer usable art that looks good in your clients’ homes, or do you offer free pizza to charity for every slice bought from your restaurant? Whatever kind of product you have, you need to make sure that there is something special that will give it a leg up from everyone else.

-

Do I Have the Resources to Get Started?

Develop a business plan to know how much money you will need for your business. Utilize connections and resources available to you, such as the people you know, the skills you have, and the assets you possess in order to make your dream business a reality. You’ll be surprised at the resources you actually have that you initially overlooked.

Before Opening your Business

Even with everything on the table, you need to ask yourself if you are capable of opening and operating a business. You have to reflect about yourself as a business owner in order to know whether or not it is worth it to open yourself up to all the responsibilities that come with opening a business.

-

What Type of Business Owner Will I Be?

There are two kinds of business owners: those who know exactly what they want to do, and those who don’t have a definite idea what they want to happen. Those in the first group are focused and have likely already developed the necessary skills in the field. Those in the second group want to get out of the corporate world and must take extra care in deciding what to do with their small business venture.

-

Do I Have the Skills to Run the Business?

Evaluate your skills honestly whether or not you are ready to own a business. Remember that the most successful small business owners build their businesses around their strengths. However it is also important not to overlook the less-enjoyable activities and responsibilities, so if organization is not your strongest suit, you may want to look into hiring someone, or at the very least, partner up with someone who can do what you can’t.

-

Do I Understand the Responsibilities That Come With Being a Business Owner?

Businesses don’t just appear out of thin air. In fact, it can present a lot of responsibilities that you may not be ready for, including gathering all the necessary legal documents such as applications for licenses and permits, tax filings, business contracts, and such.

-

Have I Set My Business Goals?

Knowing your short, medium, and long-term goals will be necessary for the success of the business. Consider not only your business goals, but your personal and economic goals as well, because knowing what you want from your business will reflect in all your other decisions.

-

Am I Ready to Change My Lifestyle?

The impact of owning a business will creep into your personal life, especially if it involves working from outside your home. The line between work and personal time will especially be blurry during the first few years and you have to remind yourself that your business problems will have to be addressed. Keep in mind that they will not go away even as you close your doors for the day.

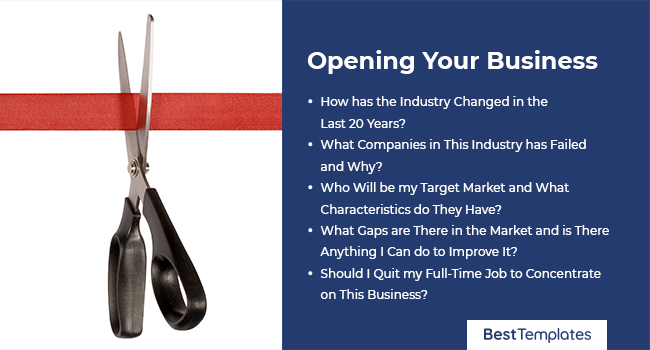

Opening Your Business

Most people find opening a business to be overwhelming, especially when things turn out the least of what they expected. Avoid unpleasant surprises by learning the market and the companies that serve as your competitors.

-

How has the Industry Changed in the Last 20 Years?

Market analysis is very important, whether you are a small business owner or heir to an empire. Understanding your market will help you identify the many factors that can impact your business, and learn to address them accordingly. Analyzing the market will help you create a projection of industries that could help your workforce plan your business development, and will let you know whether such a business in a specific industry has room to grow or not.

-

What Companies in This Industry has Failed and Why?

Failure is not something to fear, because it can act as a guide to help you improve your business. Failure actually plays a role in the learning process of business, because without it, there is no economic growth. However, instead of waiting for failure to happen to you, learn from the failures of others and apply your learnings to your own business – after all, a wise man learns from the mistakes of others.

-

Who Will be my Target Market and What Characteristics do They Have?

Knowing your target market will help you build your marketing strategy, and you need to know the characteristic profile of your buyers to be able to market effectively and be able to keep in touch with your consumer trends. Marketers design specific strategies in order to meet the needs of their target market which then will help grow their business.

-

What Gaps are There in the Market and is There Anything I Can do to Improve It?

Knowing the gap in the market is remarkable, so knowing exactly what the gap is in the market will help you create a bridge of opportunity for your business. Gap analysis will help you determine, document, and improve your business and your current capabilities. Once you understand the industry better, you can improve your own business performance.

-

Should I Quit my Full-Time Job to Concentrate on This Business?

Most people would recommend not quitting a stable job to start a small business – after all, you are not sure whether or not your business venture will be successful or lucrative. So if you are considering quitting your job, you have to create a plan that can help fund your professional freedom in the long run, just in case things don’t go as planned.

Growing Your Business

Good businessmen will not stop with just one small business, especially if their products or services have great potential. However, there are a lot of things to consider when expanding a business, and you have to be ready for the added responsibilities that come with it.

-

What Will be My Expansion Strategy?

Your business cannot move ahead without direction, so you will need to create an effective strategy. Chart out your path in starting the business so that you can navigate it in a certain direction to reach your goal. Whether you are merely adding innovative products or expanding to new locations, you have to keep investing in your business key areas as necessary.

-

What Kinds of Expansions am I Considering?

You have to strike at the right time in order for your expansion to have a positive impact on your business. You need to consider a lot of factors, including locations, offers, or even challenges in management to ensure that your business will continue to grow on a positive note.

-

Is the Market Conducive for Growth?

Business expansion is not something that entrepreneurs take lightly, so consider that all the financial and operational decisions you make will have significant ramifications on the performance of the business. Therefore, make sure that you familiarize yourself with the business environment in order to make the expansion process easier.

-

Do I Have the Finances Necessary for an Expansion?

Growing a business will again cost money, so before you decide on doing so, you may want to consider if you stand to gain financial benefits, if you have working capital to support the expansion, and most importantly, if you would be able to fund technologies and human resource related to the expansion. Make sure that in your venture, you will be able to generate profits to repay your loans, if any. After all, a debt-ridden business can spell your doom.

-

Do I Have the Necessary Manpower and Technology?

Running a business is easier if you have a competent and experienced staff manning it for you. Expanding will mean that you have to hire the talented people who can be seamlessly incorporated in your team. However, manpower alone is not enough, and should also be complemented by the right technology. In order to ensure that you will not have any problems with your expansion, you will have to ensure you have your online and offline technologies sorted out, whether you’re talking about computer software or large production machines.

Running a Sustainable Business

The sustainability of the business is not limited to monetary compensation. You also have to continuously love what you’re doing in order to continue operating at the same level that you did when you started, years down the line. Therefore, it is important to ask yourself whether or not the business is sustainable, not only in terms of finances, but on your emotional desires as well.

-

Do I Love What I’m Doing?

Most people start businesses because of passion or a desire to get out of the corporate world. However, it is important to realize that there is a big difference between being passionate about something, and having the drive to turn passion into a business. It is important to note that as time goes on, being a business owner will mean that passion will make up 20 percent of the business equation, but an even larger version will be of grit. Ask yourself if you can commit to the challenges of being in business so that you will know if you are in it in the long run.

-

Is the Business Profitable?

Without proper books, it is impossible to know whether or not your business is actually generating profits or costing them money instead. Make sure that you know whether or not you are making enough money to run and operate your business, as well as support your lifestyle. If your needs are not being met, then you have to think of strategies to help improve the state of your venture.

-

Do I Have a Life Outside my Business?

Getting the freedom of being your own boss comes with a price, usually involving money. However, real freedom will include having the time to spend with family and friends, so make sure that you have time for things that matter to you. If your business is taking up all of your time, you will most likely be on the track to a burnout, which will be bad for your business in the long run.

-

Do I Have the Necessary Support in Place?

It is important to have a solid infrastructure to help run your business. In case you get sick, or will be away from the business for a long period, you have to know that you can depend on the people managing it for you. Life is going to continue, and your business will have to run whether or not you are there physically to see it through. This means you need to make sure that you have a solid support group in place, so you can take a step back and feel confident that your business will continue running smoothly.

Closing Your Business

Sometimes, a business venture does not go as planned, and while you still feel that you have the desire of putting all your time, money, and effort on the business, it’s is not always for the best. In fact, you also have to learn when to cut your losses, no matter how difficult it can be. Weigh the pros and cons of keeping your business before making a difficult, heartbreaking decision.

-

Am I Still Meeting My Annual Revenue Projections?

If, two or three years into your business and you’re still not turning profit, you may have to consider cutting your losses in order to avoid personal financial troubles. Closing up shop can be difficult, but knowing when to do so can save you money and heartbreak, so consider regrouping and starting again.

-

Has my Health Suffered due to the Challenges I have been Facing in Business?

Being unhealthy – physically, mentally, and emotionally, means you should evaluate whether or not the decline in your health is worth it. If the dreaded feeling that you had in facing your 9-5 corporate job comes back at the thought of having to go to your business headquarters, then you may have to reconsider at least the direction in which your business is going.

-

Is the Business Mission Still Clear and Motivating for me?

Forgetting why you started your business in the first place is a sign that your company is going downhill. If your objectives are becoming hazy, or if you are losing your passion for your business, then you have to find ways of pushing your business forward, or think of closing it down, before you find yourself on the deep end.

-

Do I love my Products More than my Customers do?

If you are really passionate about something, you will find that you will have a tendency towards bias. Sure, you love your products, but if your customers do not love it as much as you do, and if you’re not seeing positive feedback through your revenues, then you may want to reconsider your business. Without sales, your brand will suffer, so more important than your love for your product is the love your customers have towards it.

-

Do I Still have my Key Employees?

The owner of the business is usually the last to know if it is going down south, and this is especially true when the expert team that helped you build your business starts leaving for greener pastures and better opportunities. If this is happening, you have to ask yourself whether or not your employees know something that you haven’t yet, and you should probably consider closing.

-

Is there a way for me to Rebound?

Purposely stagnating the business and stripping it down to its bare bones while waiting for the market to rebound is an option that some entrepreneurs could take. However, this is not always plausible. If you cannot afford to operate at your bare minimum and wait for a market rebound, then you may want to find other ways to increase revenue – or close down before your business completely fails on you.

Selling Your Business

Selling a business is not a spur-of-the-moment decision, and there are a lot of things to consider before doing so, such as whether or not you think the business has potential enough to grow without you, or if it will fall into the hands of people who have the same values and ethics as you do. Ask yourself whether you will gain more by keeping your business or by selling it to others who have the capacity to help it grow.

-

Is the Business Ready to Sell?

Don’t sell your business when you feel that you are no longer turning a profit. In fact, experts believe that you have to prepare your business for at least two years before selling, at which time, you have to produce accurate tax returns and show maximum profitability. This way, you can get a good price for your business.

-

How will the Buyer Value my Business?

Avoid loading the business with tax write offs, because this can make you appear less profitable to buyers. When they see companies running everything through the business, such as their car allowances or club memberships, the overall revenue will look significantly less and buyers will tend to undervalue the business.

-

Will I be Willing to Stay With the New Owners if they Want me to?

Some buyers may ask you to stay on with the business for a consulting role that could last up to six months. You have to determine whether or not this is worth it to invest more time in a business that you wanted to let go in the first place. However, the buyer might see staying on as a reduced risk and an increase in your company’s value.

-

What are Some Potential Deal Breakers?

If you have a lot of unresolved issues that could interfere with the sale of your business, you may have to clear them up before selling. Some of the biggest deal breakers for buyers include company ownership issues, accounting, and even intellectual property rights. If you have any of these issues to deal with, you may have to postpone the sale of your business until everything is resolved in order to avoid putting off buyers.

-

Should I Consider other Alternatives to an Outright Sale?

If you feel that you are not yet ready to sell, you may want to look into hiring an accountant or investment banker to help you evaluate your options. Structuring deals to pass ownership to employees, or doing a recapitalization may also be options that you can look into.

Buying an Existing Business

Buying an existing business may seem easier than starting your own from scratch. After all, everything you need is already there and the customer base is already established. However, there could also be a reason for the owners to be selling their business, so make sure to do your research properly before deciding to buy a business.

-

How did the Owners Arrive at Their Asking Price?

Knowing their thought process in arriving at their asking price will help you get a sense of your bargaining power. If you know how the seller arbitrarily arrived at his asking price, you can gauge how much room you have for negotiation. What are the biggest challenges that the business is facing at the moment? Knowing what challenges the original owners are facing is necessary so that you will know whether or not they have overvalued their business.

-

Do the Owners have Past, Pending, or Potential Lawsuits?

One of the worst things to inherit in business is a lawsuit, so you have to ask the current owners if there are legal proceedings that you have to be concerned about. For protection, you may want to get their response in writing, just in case the owner is concealing legal problems.

-

Does the Business Depend on Key Customers or Vendors?

Businesses that look successful at face value could be problematic if it relies too much on any one customer or vendor. Buying it may be a risk, especially if these key persons have a sense of loyalty to the original owners.

-

Do I Have the Skills or Qualities Required to Run this Business?

No matter how successful a restaurant is, you have to know whether or not you posses not only the skills to run the business, but the necessary leadership qualities as well. Acquiring a business will mean that there are some things that customers have come to expect, so you have to be able to live up to their expectations – and more.

Questions Regarding the Organization of Your Business

Business is 20 percent passion and 80 percent hard work. This means that no matter how much you believe in your business, you also have to take a lot of time going into the more technical things such as accounting and finance, human resources, management, sales and marketing, customer relations, and most importantly, the legal aspects.

Accounting

An accountant can assist you with the tracking, analyzing, and securing your accounting records. However, you need to make sure to find one that specializes in small business so that you will be able to ask him or her the following questions:

- What Records Should I Keep? Keeping track of business records is necessary in filing taxes and measuring profitability, so make sure to ask your accountant to show you which records you have to keep. Some examples include revenue, operating expenses, tax remittances, employee wages, and purchase and sale of assets.

- What Business Structure Should I Use? There are different kinds of business structures to consider: sole proprietorship, partnership, limited liability corporations, and corporations. Each of these structures have pros and cons, especially in liability and tax returns, so you have to discuss how to best structure your business.

- What are my Financing Options? Your accountant can help you look over your financial situation and assess whether or not you can seek financing help from investors or via bank loans. They can also assist you in your loan process and compile financial statements as necessary.

- What Should be my Break Even Point? Your break even point shall be when your total income will equal your total expenses. Your accountant can help you figure out your break even point, which is essential in helping you price your products and services. Accountants can help you figure this out by properly assessing your financial records.

- When Will I Need to Pay my Estimated Taxes? Your accountant will know the tax schedule for the current year, and explain to you the amount you have to remit, as well as the forms to file. If you plan on employing a full-time accountant, he or she can remit the estimated taxes for you, making that important part of the business that much easier.

Financial

The prospect of starting your own business certainly seems like you’re taking steps to make your dreams a reality. However, very few businesses actually make it past five years, and the high rate of failure can be scary. If you feel that you are not great with managing your cash flow, you have to ask yourself the hard questions.

- What Expenses do I have to Take into Account, and How Much will They Cost? Initial startup costs and ongoing overheads are the most important costs in business. Decide on the things that you absolutely need to get started, such as computers, furniture, inventory, and other items. Figure out how much you have to pay every month to keep the business going, such as costs of rent, employee salaries, internet services, electric and water bills, and other expenses.

- How Much Capital Will I Need? You have to be able to determine how much capital you will need to start your business. In order to do so, you have to compute the costs of starting the business, plus six months worth of operating money on hand. Overestimating your initial costs will work better than limiting yourself on a stark budget.

- Where Will I Get my Funding? After discussing your options with your accountant, you will have to assess which kind of funding will work best for you. There are different variables to consider, but for most startup businesses, budding entrepreneurs tend to ask for assistance from friends or family.

- Will I be Able to Keep a Handle on Both my Personal Financial Situation and Business at the Same Time? You have to be able to take care of yourself as you transition to being an entrepreneur. Do not make the mistake of neglecting your personal financial situation because doing so will leave you on a slippery slope. Remember that you have to put money aside for your future as well. You don’t want to risk everything you have in case the business does not turn out as planned.

- Where do I Want to be in the Long Run? Every aspiring businessman should have two sets of financial goals – your personal goals and your business goals. Having a personal and business plan on where you want to be five to ten years down the line will keep you focused.

Human Resources

Building your own Human Resources Department will take some work, which is why you need a solid plan. After all, human resources deal with a lot of your company’s issues, including employee compensation, performance management, safety, wellness, salaries and benefits, and even employee motivation and training.

- Do I Understand my Company’s Job Profiles and Staffing Plans? Human resources will help you create each role in the company and find the person who can fill it. In fact, in many startups, you can use these profiles to create a hierarchical structure in the company. Proper structure can help you with your future tasks such as workforce planning, succession, and even outsourcing when necessary.

- Is it Time for the Business to have a Hiring and Staffing Business Plan? Smaller companies tend to start with Excel spreadsheets and emails, but a more organized business owner would invest in good software for a better application and staffing system to make the job of human resources that much easier.

- Do I Need Help with Employee Salaries, Compensation, and Benefits? Not all companies offer the same traditional benefits, but there are some that are mandated by the government, and human resource can help you in complying with all of these. Otherwise, they can also help you offer creative compensations and benefits for your employees.

- Do I Want my Employees and Managers to Develop Their Skills? While many small businesses don’t feel that they need to set up a training and development process, it is important that your employees will also get something out of working with you. You can work hand in hand with human resources to build mentoring programs or find learning opportunities for your staff.

- Do I have a Way to Measure Employee Performance? Companies these days enforce performance evaluation in order to measure the individual successes of employees. These evaluations will change over time as the company grows. However, it is important that the evaluations are constant and measurable to create a concrete, objective performance measuring process.

Internet and Technology

Investing in technology, whether software or hardware, should be on top of your priorities. This is because technology gets the job done in this day and age. So whether you are choosing your internet provider, looking into your software, or discussing appliances and machinery, you have to be aware of the pros and cons of what you will be purchasing.

- Am I Aware of all the Technology to Make Things Work? If you’ve ever owned so much as a smartphone, you will know that hardware and software go hand in hand. Make sure that you know which ones go with each other, and which additional software or hardware you will need to make everything run smoothly.

- How Long has This Technology Been Around? New does not always mean reliable when it comes to technology. So wait out the reviews and let others discover the hidden bugs. Hang back and wait for reviews to come in so that you will not risk your money on expensive products that may not last a long time. If you prefer, you may buy tried and tested products instead.

- How Will the Technology Help me Generate Profits? Make sure that in selecting technology, it will help you increase revenue, or decrease costs. Busying software and hardware should be quantitative. Calculate how much the profits will result from the investments.

- Can I Take the Technology to a Test Drive? When it comes to your business, don’t take the word of the vendor, or their demo. It is important that the hardware company can give you a test price. If not, then you should think about reconsidering, because due diligence is of utmost importance when you’re putting your money in a business.

- Will the New Technology Sync up with my Other Systems? Proprietary systems are now a thing of the past, thanks to technological innovation that makes a lot of apps and software available at affordable prices. When you buy software, you have to make sure that they are compatible with the existing technology that you already have, or at least hire someone to make sure they are integrated properly for you.

Legal

Speaking with a business lawyer will help you understand how to start a business. More importantly, your lawyer will also help you identify the risks and find ways to minimize them. When you meet with your business lawyer, it is important that you ask them essential questions, some of which will be a good start:

- What do I Need to Know in Choosing my Business Name? There are actually a lot of legal issues that you have to consider when picking your business name. Different states have rules regarding the names that business entities can use, and you are not allowed to use a name of an already existing business. Another conversation is necessary in case you want to trademark your business name, too, so a lawyer will definitely come in handy.

- In What Ways can I Protect my Intellectual Property? Even small businesses can have trademarks for their own use to distinguish it from others – may this be the business name, logo, labels, slogans, or even packaging. However, you will have to make sure that you are taking steps to protect youe trademarks, such as registering it with the US Patent and Trademark office. Copyrights for original works such as photographs and brochures, and even websites should be prioritized, especially for the creative types. If you have an invention, patent applications should be your priority. A lawyer will definitely help you sort out all your intellectual property issues right from the start.

- What Should be Included in the Business Operating Agreements and Bylaws? Operating agreements and corporate bylaws are very important in providing guidelines for your business. These documents will help explain things such as decision-making agreements and shareholder meetings, so you will need your lawyer to assist you in preparing them based on the needs of your business.

- What Contracts are Needed for my Business to Operate? Contracts will discuss the rights and responsibilities of the parties who have signed the applicable agreements. A well-written contract will ensure that there will be little to no disputes in the future, and if there are, the contract can help remedy the situation. Your business will need a lot of contracts from routine transactions, to confidential information, leases, and even employment relations, to name a few.

- What Risks Should I be Aware of? Different businesses will face unique risks, so you will have to ask your lawyer to help you assess risks and find ways to guard your business against them, whether in the form of contracts, loans, or insurance.

Planning and Management

Businesses need to do annual financial assessments to see where they stand. Proper planning and management will tell you how well your business is performing, whether or not you are taking proper advantage of your opportunities. Whether you need to update your business plan or move to a different direction – proper planning and management will help you assess your business from the start, and every year thereafter.

- What Does the Business Actually Offer? Think of what your core activities, products, and services are, and assess whether or not you have been successful in delivering them to your customers. Do your offers on products and services match customer needs? Which products and services performed best, and which ones performed worst? Being able to assess your business will help you move forward and improve how you run your business.

- How Efficient is the Business? You have to make sure that everything in your business is efficient. Internal factors could affect your business so you have to investigate premises and facilities as well as information and technology systems to make sure that they still meet your needs. Not only that, you have to assess your staff and whether they have built their skills for the improvement of the business.

- What is the State of my Finances? Assess your cash flow, your working capital, the ongoing costs, even the debts and loans that you accrued for the business. Develop a plan to help you adapt to the continuous change in the market, including the changes in your customer base and other business needs.

- What are my Competitors Doing that I Could Adapt or Improve on? Even if you’ve done a competitive analysis before you started your business, it is important that you continue doing so on a regular basis in order to gauge your standing in the market, and keep track of the changes and trends in the industry that you are in.

- Should I Change my Marketing Plan and Redefine my Business Goals? Developing a marketing plan at the beginning of the business will probably not work as well later on, so an annual analysis will provide a great opportunity for you to review your marketing plan and adjust it as necessary. As the business landscape changes, you should also take into account the changes in your customers and competitors. Developing an ever-changing business and management plan will help your business grow and improve, and likely continue your success in the future.

Sales and Marketing

Managing the day-to-day activities in your business is not going to be enough, focusing only on operations will stunt the growth of your company dramatically. A good sales and marketing strategy will help the business reach a wider audience, which means more potential customers for you. Good strategies will help build your business systematically.

- Who are my Main Competition? Upon starting your business, you should be aware of your competitors in the industry, and you should know how they price their products and promote them. This information will be beneficial to you when you put your own intent for your own marketing strategy.

- What is my Marketing Intent? You should be able to figure out whom the customers are that you are selling to, what products you are selling, and how your products differ from everything else in the market. From these information, you should be able to identify what you intend to achieve in your marketing strategy.

- How much is my Budget? In documenting your marketing plan, it is important to include a section on funds allocation for each of your planned strategies. This will help you determine where you can save on in-house costs. Some businesses also consider monthly marketing budget schedules to keep track of the costs over time, allowing you to set your sales goals accordingly.

- What Strategies will my Marketing Plan Include? You should be able to include tactics and strategies that will help you gain access to your customers. Some of the most budget-friendly marketing strategies include public relation works, email and social media marketing, trade shows, partnerships, and webinars.

- How will I be able to Measure Success? The most obvious way to measure success would be to base it on your revenue, however, you may want to look forward to what happens after the initial buzz of your latest strategy. You have to track your progress and make changes to your marketing strategy as necessary. Monitor the number of visitors or customers, as well as leads that lead to sales, in order to gauge how successful your marketing strategy is becoming.

Customer Support and Relations

Going hand in hand with sales and marketing are customer relations. Once your business has sustained a rapid boom, better customer relationships can help you achieve your sales targets in the long run. In fact, startup companies can use customer relations to accommodate growth, so it is imperative that you choose your customer relations platform early on.

- Do I have a Sustainable Growth Plan for my Business? You have to keep track of your contact, prospects, partners, and investors as the business grows, and a good CRM solution will help you keep track of all of that. With good customer relationship management plan, you can present a sleek, organized image of your business to your customers and potential investors.

- Do I Need Help in Spotting Market Trends to Further Improve my Business? CRM can help take advantage of business opportunities. Customer relations come equipped with artificial intelligence and analytics that will help them spot trends and therefore allow you to identify that can lead to more sales, as you allow them to better understand your customer behavior.

- Am I Open to Collaborative Selling? A good businessman knows that there is no “lone wolf” approach in sales, especially for more complex products. A centralized CRM database will help sales and customer support teams take a collaborative approach in customer relations. This way, the process is more transparent and you will open your business to its best practices early on.

Other Activities

Running a business is not limited to sales and operations. In fact, one of the biggest challenges in business involve money and finances, such as investing and finding investors, or improving the overall business such as your core strategies, or increasing productivity.

Investments and Investors

Pitching to investors will be among the most important aspects of starting a business, which is why it is important that you know exactly what you want to achieve, and how to get there. If you are not yet familiar with how investments work, you should hire a finance manager who will help you with your investment plans and can help you understand the most basic questions to help finance your ventures.

- How does the Investment Work? You have to understand how the investment works as well as the risks that you may have to take if you decide to proceed. There are different kinds of investments for different time frames, so you have to be able to understand what you’re pitching in order to convince investors to put money up for your business.

- What are my Goals, and Where do you Think your Sales will be in the Next Year or so? When you try to convince investors to put money in your business you have to be able to tell them whether they can get safety, income, or growth from their investments, and whether or not they will have to pay for taxes on the money that they earn. Knowing where you will be in a year’s time will also give investors a glimpse of the opportunities that they could have, both in the short and long term.

- What part of the Business is Giving me the Most Trouble? Knowing the most challenging part of your business will help you identify its potential weaknesses, and give you insight for your earnings in the future. However, identifying the problems is just one part of the equation, so you will also have to know how to resolve them in order to convince investors that there won’t be a shortfall of earnings by investing.

- What is my Potential Investor’s Typical Investment Size? Investors put money in differing amounts. Some start investing at $25,000 to $100,000, while others could go upwards of $250,000. Research your potential investor’s typical investment size so that you won’t waste his or her time by pitching a business he may not be interested putting money in.

- How does my Business fit Within my Potential Investor’s Portfolio? Investors may have likely put their money in other emerging businesses as well, so you have to research where they usually put their money in. If you find that they don’t have any other businesses in their portfolio that is similar to yours, then expect a quick meeting with them. However, having too many similar businesses may also impact you negatively if you run into a conflict. Therefore, it is important that you find an investor with just the right number of analogous companies that could share your business model, but ensure that they are not your direct competitors.

Opening a Franchise

Buying a franchise can be tricky, which is why it is necessary that you do your research before entering into an agreement. There are some essential questions that need to be asked of a franchisor so that you will know whether or not your personal business ethic fits well with the larger company’s dynamic.

- How Much do I have to Invest? Initial investments for franchises can vary from a few thousand dollars for small businesses, to millions for established corporations. However, franchisors should be able to answer the question as the Franchise Disclosure Document should list the initial franchise fee and start up costs that includes real estate, equipment, and licenses. Speak with the franchisor and discuss clearly the investment and what is needed financially to get it up from the ground.

- How Strong is the Franchise Company, Financially? The most recent financial statements of your potential franchisor will give you an indication on the company’s financial standing. You could ask your franchisor to explain how they arrive at the bulk of their income, and whether the funds trickle down to the system. How much money can I make? While it is impossible to predict the success of individual branches, your franchisor should still have a good grasp on how much income franchisees potentially earn. However, they may choose to withhold some details such as operating expenses.

- Would the Franchisor Offer Support Beyond the Initial Training? In order to get the franchise up and running, the franchisor typically offers initial training. However, you may want to compare what each franchisor has to offer because accessible support on a day-to-day basis may be key to the success of the business.

- What would the Franchise Owners Expect of me? Franchisors will have certain expectations from you, especially regarding payments, operations, and other obligations as already drafted in your franchise agreement. Therefore, it is important that you have a proper discussion to better understand what is required of you as a franchisee.

Core Strategies

Your company’s strategy management will take a lot of time and resources. More often than not, it may even take you away from focusing on the day-to-day operations of your business. However, today’s technology offers far better options, and owners have recognized the value of having a strategy that helps improve business in a consistent manner. Therefore, it is important for the improvement of your business that as the owner, you are clear about your company’s core strategies.

- Am I Capable of Doing this Business? You are more likely to become a successful entrepreneur by following your capabilities instead of the market you want to make a mark on. Sometimes, what you’re passionate about may not be as lucrative or as sensible a business. This is why you have to ask yourself whether or not you have enough grit to make the business successful.

- Does the Business have the Credibility it Needs to Create an Effective Marketing Strategy? Many people tend to overlook the fact that the company’s credibility will give them an automatic leg up in letting customers believe the messages that they deliver through their campaigns. Startup businesses will have a particularly hard time getting their customers to believe in them, so you need to be able to communicate effectively in order to make an impact on your business.

- What Would be my most Effective Strategies? When you are able to identify your target audience, you will have to find a way to get them to come to your business. The way in which you will implement your strategy will play a big role in influencing your target clientele as they pick up information.

Knowing the answers to all these questions about small business documents, strategies, and processes will help you get a head start in becoming the entrepreneur that you want to become. So learn as much as you can before you dive in the deep end of the business swimming pool – after all, there is a lot to lose, but far more to gain if you are effective in this venture.